-

Main residence CGT exemption about to slip through foreign owners’ fingers

Posted by Team AVS on 29 Oct, 2018 0 CommentsAs most readers will know, prior to 1985 Australia had no general tax on capital gains. But after the capital gains tax (CGT) regime was introduced in that year (September 19 specifically), the main residence exemption has been a feature ever since.

While there have been a number of changes and clarifications to the specifics of the exemption, the high-level principle has largely remained the same—namely that a dwelling used as a principal p

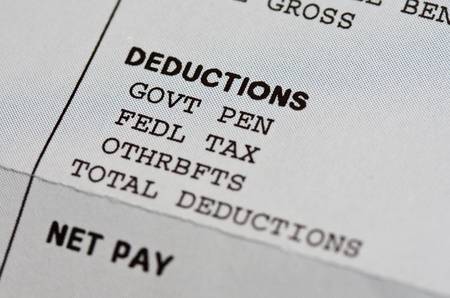

The government recently released exposure draft legislation that removes the ability of taxpayers to deduct certain payments – including payment of wages and payments to contractors – if the entity making the payment fails to comply with its obligations to withhold and report information to the ATO.

If the PAYG withholding regime applied to the following payments, and the payer did not withhold the amount from the payment as required or di

If the PAYG withholding regime applied to the following payments, and the payer did not withhold the amount from the payment as required or di

AVS BusinessServices @ What the

AVS BusinessServices @ What the